Preparation of documents for filling out the PIT

To fill out a tax return correctly, you need to carefully prepare all the documents. An experienced online lawyer can conduct a detailed legal analysis of the documents and help determine which papers are required. It is important to have the documents checked by a lawyer to avoid mistakes when filing the declaration.

Documents required for PIT:

- PIT-11 document from the employer

- Confirmation of additional income

- Documents on benefits and deductions

- Documents on the place of residence

- Confirmation of charitable contributions

A professional legal analysis of the situation will help you prepare all the necessary documents correctly.

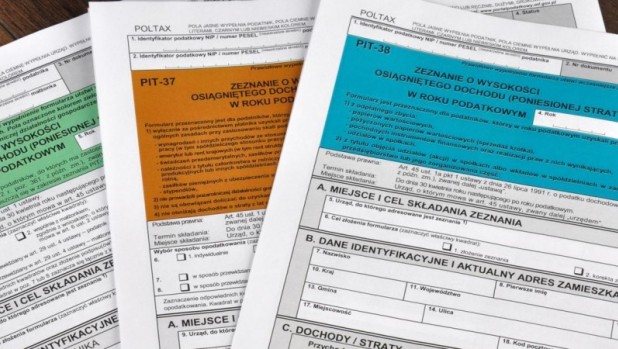

Choosing the right form of PIT

An important step is to choose the appropriate form of the declaration. A qualified lawyer in Poland will conduct a legal analysis and help you choose the right type of declaration.

Types of tax forms:

- Declaration for employees

- Forms for entrepreneurs

- Declarations for freelancers

- Special forms for non-residents

- Forms for combined income

Timely legal advice will help you avoid mistakes when choosing a form.

Rules for filling in the main sections

Each section of the declaration requires special attention. An experienced online lawyer can provide written advice on the correct filling of all fields.

Question

Is it possible to correct errors in a PIT declaration that has already been submitted?

Answer

Yes, errors in the submitted return can be corrected by filing a corrective return. It is recommended to obtain a legal opinion of a lawyer on the necessity and procedure of filing corrections.

Calculation of tax deductions

The correct calculation of deductions is a key element of filling out the PIT. A qualified lawyer in Warsaw will conduct a legal analysis and help you determine all possible benefits.

The main types of deductions are:

Education expenses

Medical expenses

Charitable contributions

Mortgage interest

Professional expenses

A competent legal analysis of the situation will help to maximize tax benefits.

Electronic filing of the declaration

Modern technologies allow you to file PIT online. An experienced lawyer can provide a legal opinion on the peculiarities of electronic filing.

Advantages of online filing:

- Processing speed

- Automatic error checking

- Confirmation of receipt

- Ability to track the status

- Storage of electronic copies

Professional legal advice will help you file your tax return online safely.

Peculiarities of declaring foreign income

When filling out the PIT, it is important to correctly reflect income received abroad. A qualified online lawyer can conduct a detailed legal analysis of the situation and help you avoid double taxation. A timely written consultation will help you understand all the nuances of international taxation.

Declaration aspects:

- Currency conversion at the official exchange rate

- Accounting for taxes paid abroad

- Application of international agreements

- Documentary evidence of income

- Peculiarities of taxation of different types of income

Professional legal analysis of documents will ensure the correct reflection of all income.

Taking into account tax benefits and discounts

Proper use of available benefits can significantly reduce the tax burden. An experienced online lawyer will conduct a legal analysis and determine all possible tax preferences.

Available benefits:

- Benefits for children

- Discounts for charity

- Deductions for education

- Benefits for young professionals

- Preferences for scientific activities

A qualified legal opinion of a lawyer will help you to make the most of the available benefits.

Common mistakes when filling out PIT

Understanding common mistakes will help you avoid them. A competent lawyer in Poland can conduct a legal analysis of typical situations and provide recommendations for their prevention.

Question

What are the consequences of making mistakes in the PIT declaration?

Answer

The consequences may range from the need to submit a corrective declaration to financial penalties, depending on the nature and seriousness of the error. It is recommended to obtain a legal opinion from a lawyer to assess the risks and correct the errors properly.

Filing deadlines and liability

Meeting the deadlines is critical. An experienced lawyer in Warsaw will conduct a legal analysis of the situation and clarify the liability issues.

Important aspects:

Calendar for filing declarations

Tax payment deadlines

Penalties for delays

Possibilities of extending the deadlines

Appeal procedures

Professional legal advice will help you meet all the necessary deadlines.

Completing a PIT tax return requires attention to detail and an understanding of tax law. Timely legal analysis and professional assistance can greatly simplify this process and help avoid mistakes and penalties. For qualified assistance in taxation matters, please contact the legal marketplace CONSULTANT. Our experienced specialists will conduct a detailed analysis of your situation and help you prepare and submit a tax return correctly.

Storage of documents after filing a PIT

Proper storage of documents after filing a tax return is important. An experienced lawyer can conduct a legal analysis and provide recommendations on the terms and methods of document storage. A professional legal analysis of the situation will help to avoid problems during possible audits.

Recommendations for storage:

- Creating electronic copies

- Systematization of paper documents

- Protection of confidential information

- Observance of storage periods

- Organization of quick access

Qualified legal advice will help you to properly organize your document archive and ensure its preservation for the required period. For more information and professional assistance in taxation matters, we recommend that you contact the legal marketplace CONSULTANT, where experienced specialists will provide you with all the necessary support and ensure the correct execution of tax documentation.

Filling out the PIT in Poland on your own requires care and knowledge of tax legislation. Proper legal analysis of documents and professional assistance can greatly simplify this process and help avoid mistakes. To get qualified assistance in filling out the tax return, we recommend that you contact the legal marketplace KONSULTANT. Our experienced specialists will conduct a detailed analysis of your situation, provide a legal opinion and help you fill out and submit the PIT correctly. Do not risk your money and time - entrust your tax reporting to professionals!