Basic principles of inheritance in Poland

Polish law regulates inheritance issues in great detail, and it is important for foreigners, especially Ukrainians, who have property or relatives in Poland to understand these nuances. The process of inclusion in the circle of heirs can be complicated, so it is often recommended to seek the advice of a lawyer specializing in international inheritance law. A legal analysis of the situation will help determine your rights and opportunities in a particular case.

The basic principles of inheritance in Poland include:

- Inheritance by law

- Inheritance by will

- Mandatory share in the inheritance

It is important to understand that Polish law may differ significantly from Ukrainian law, especially in matters of determining the order of heirs and the size of their shares. Therefore, a legal analysis of inheritance-related documents is critical to protecting your interests.

Procedure of inheritance by law

If there is no will or it is recognized as invalid, inheritance takes place by law. Polish law establishes a clear hierarchy of heirs, which may differ from the one familiar to Ukrainian citizens. A legal consultation will help you understand which line of heirs you belong to and what share of the inheritance you can claim.

The lines of heirs by law in Poland are:

Children and spouses of the testator

Parents of the testator

Brothers and sisters of the testator and their descendants

It is important to note that even if you are not in the first line of heirs, you may still have the right to inherit. A lawyer in Poland will be able to conduct a legal analysis of the situation and determine your chances of being included in the circle of heirs.

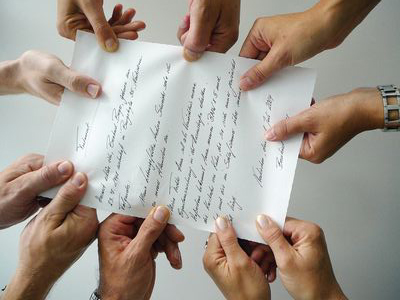

Inheritance by will

Inheritance by will in Poland has its own peculiarities that must be taken into account when drafting or challenging a will. The legal opinion of a lawyer on the validity and legal force of a will may be crucial for the successful resolution of inheritance issues.

Key aspects of inheritance by will:

- Form of the will (handwritten, notarized, oral)

- Restrictions on the freedom of will (mandatory share)

- Grounds for contesting a will

Question

Can a foreigner be included in the circle of heirs in Poland?

Answer

Yes, a foreigner can be included in the circle of heirs in Poland. Polish law does not discriminate against heirs based on nationality or citizenship. However, the process may be more complicated due to the need to prove family ties and legalize documents. Consulting a lawyer specializing in international inheritance law will help you properly prepare all the necessary documents and protect your rights as an heir.

For foreigners, it is especially important to conduct a legal analysis of inheritance-related documents, as questions may arise regarding their compliance with Polish law and the need for additional legalization.

Mandatory inheritance share

Polish law provides for the institution of mandatory inheritance, which protects the rights of the testator's closest relatives, even if they are not mentioned in the will. Understanding this aspect is important both for potential heirs and for those who plan to draw up a will. A legal analysis of the situation will help determine whether you are entitled to a mandatory share.

Persons entitled to a mandatory share:

- Children of the testator

- Spouses of the testator

- Parents of the testator who are in a difficult financial situation

The amount of the mandatory share and the procedure for obtaining it can be difficult to understand without special legal knowledge. An online lawyer can provide written advice on your rights to a mandatory share and help you obtain it.

Procedure for inclusion in the circle of heirs

The process of inclusion in the circle of heirs in Poland can be quite complicated, especially for foreigners. It includes several stages, each of which requires careful preparation and knowledge of Polish law. Legal analysis of documents at each stage can significantly increase your chances of a successful outcome.

The main stages of inclusion in the circle of heirs:

- Submission of an application for inheritance

- Obtaining a certificate of inheritance

- Distribution of inherited property

Question

What documents are required to be included in the circle of heirs in Poland?

Answer

The following documents are usually required for inclusion in the circle of heirs in Poland: death certificate of the testator, documents confirming kinship (birth and marriage certificates), a copy of the will (if available), documents confirming the inherited property. For foreigners, additional documents such as apostille or legalization may be required. A lawyer in Warsaw can have the documents checked by a lawyer and help prepare a complete package of necessary papers.

It is important to remember that all documents must be translated into Polish by an official translator. The legal opinion service will help to make sure that all documents comply with the requirements of Polish law.

Appealing against inheritance decisions

In some cases, it may be necessary to appeal against a court decision regarding inheritance or a will. This is a complex process that requires in-depth knowledge of Polish law and case law. An online lawyer can provide an initial consultation on the prospects of appealing and help prepare the necessary documents.

Grounds for appealing against inheritance decisions:

Identification of new circumstances of the case

Violation of procedural rules in the proceedings

Incorrect application of substantive law

It is important to understand that appealing against inheritance decisions has time limits. Therefore, if you believe that your rights as an heir have been violated, it is recommended that you immediately seek a legal opinion from a lawyer specializing in inheritance cases in Poland.

Inclusion in the circle of heirs in Poland is a complex legal process that requires a deep understanding of Polish law and case law. This is especially true for foreigners, who may face additional difficulties in confirming their inheritance rights. A legal analysis of the situation, legal analysis of documents and legal advice at every stage of the process can significantly increase your chances of successfully resolving inheritance issues. Regardless of whether you are claiming an inheritance by law, by will, or trying to obtain a compulsory share, professional legal assistance is critical. If you are faced with inheritance issues in Poland, we recommend that you contact the legal marketplace KONSULTANT. Here you can find a qualified lawyer in Poland who specializes in international inheritance law. Our experts will conduct a detailed legal analysis of your situation, provide written advice and help you protect your rights in Polish courts. Don't risk your inheritance - entrust the solution of inheritance issues to professionals from CONSULTANT.