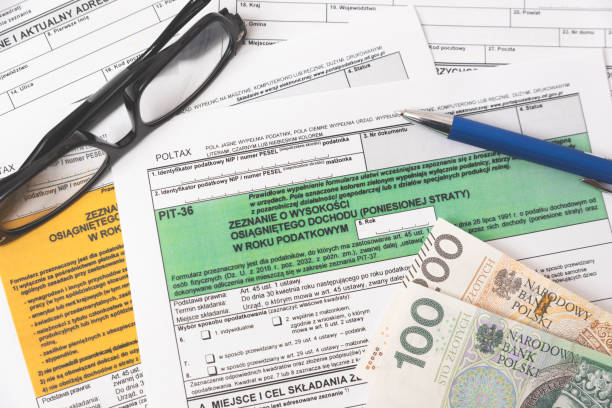

Polish tax legislation is considered one of the most formalized in the European Union. For foreigners who work, do business or receive income in Poland, it often becomes a source of increased risks. Differences in tax systems, the language barrier, the complex structure of declarations and frequent changes in rules lead to the fact that errors in tax declarations occur even among conscientious taxpayers. At the same time, the Polish tax authorities do not distinguish between intentional and unintentional violations if they lead to an underestimation of tax obligations.

Theoretical principles of taxation of foreigners in Poland

The key issue for every foreigner is determining tax residency. It depends on it what income must be declared in Poland – only received in the country or also income from abroad. Tax residency is not determined by citizenship, but by actual circumstances: duration of stay, center of vital interests, place of work or business. Foreigners who become tax residents are obliged to declare all income, regardless of its source of origin.

This rule is often ignored or misinterpreted, which is directly related to the topic of foreigners' taxes and the risks of being held liable.

Typical errors in tax returns of foreigners

In practice, the following errors in tax declarations are most often recorded in tax returns:

- incorrect determination of tax residency;

- failure to declare part of income or bonuses;

- submission of an inappropriate PIT form;

- ignoring income received outside Poland;

- missing the established deadlines for submitting declarations;

- failure to make adjustments after detecting an error.

Even formally insignificant inaccuracies can become grounds for additional tax assessment, which entails tax penalties in Poland and additional financial costs.

Tax fines and inspections: what threatens foreigners?

The Polish tax system provides for a wide range of sanctions. In case of violations, the following are possible:

- financial fines of various sizes;

- the accrual of penalties and interest;

- a tax audit for several previous tax years;

- administrative or financial liability.

For foreigners, tax problems can have wider consequences. In some cases, they affect the legality of stay, the extension of residence permits or the possibility of obtaining a residence card. That is why the issue of fines taxes Poland goes beyond the purely financial plane.

Why legal assistance in tax matters is important?

Independent attempts to correct errors or correspond with tax authorities often worsen the situation. Professional legal help allows you to act within the law and taking into account procedural nuances. Legal support includes analysis of declarations, risk assessment, preparation of corrective documents and representation of the interests of the payer. Thanks to the timely involvement of a lawyer, you can:

- detect errors before the audit begins;

- correctly submit clarifying declarations;

- minimize or avoid penalties;

- correctly respond to requests from tax authorities;

- reduce the likelihood of a tax audit.

How a lawyer helps foreigners in practice?

Legal support of tax cases for foreigners is comprehensive. The specialist analyzes sources of income, residency status, application of international agreements on the avoidance of double taxation and the correctness of the choice of tax form. Particular attention is paid to situations where foreigners taxes were paid partially or in violation of the deadlines. In the case of an already open audit, the lawyer supports communication with tax authorities, prepares explanations and a legal position, which allows reducing financial consequences and protecting the client's interests within the framework of current legislation.

Errors in tax calculations of foreigners in Poland are common, but their consequences can be serious. Timely analysis of declarations, correct determination of residency and a professional approach to correcting inaccuracies allow you to avoid fines and lengthy inspections. If you have doubts about your tax obligations or have already encountered problems, contact Consultant Legal Marketplace. Our specialists will provide qualified legal assistance, help minimize risks and accompany you in tax matters in Poland.

FAQ

Question

Are foreigners obliged to declare income from abroad in Poland?

Answer

Yes, if a person is a tax resident of Poland, he must declare all income, regardless of the country of receipt.

Question

What are the consequences of errors in tax returns?

Answer

Errors can lead to additional tax, fines, interest and a tax audit.

Question

Is it possible to correct tax errors yourself?

Answer

It is possible, but without knowledge of the procedures it is not always effective. Legal support reduces the risk of additional sanctions.

Question

Do tax violations affect migration status?

Answer

In some cases, yes, especially if the violations are systemic or accompanied by significant debts.

Question

When should you seek legal assistance?

Answer

The best time is before the start of the audit or immediately after receiving a letter from the tax office in order to protect your interests in a timely manner.