Obtaining a tax identification number in Poland is an important administrative step for foreigners who plan to work, do business, or fulfill tax obligations in the country. The tax identification number of the payer is used to identify an individual in tax authorities, submit declarations, pay taxes, and interact with public administration.

In practice, foreigners often face questions about how to get a NIP number, how to obtain a NIP number without errors, or confuse NIP with PESEL. Such inaccuracies may lead to delays or the need to resubmit documents. It is important to understand that a foreign tax identification number issued in another country does not replace the Polish NIP and is not used within the Polish tax system.

What is a tax identification number and who needs it?

Explaining what a tax identification number is, it should be noted that it is a unique digital code assigned to a taxpayer for identification within the taxation system. The tax identification number of an individual is used when a person does not have a PESEL number or is required to use NIP as the primary identifier. A tax identification number in Poland is required for foreigners if they:

- carry out employment or civil law activities;

- open a business;

- file tax returns;

- receive taxable income in Poland;

- do not have a PESEL or use NIP as the main tax identifier.

In each case, the grounds for assigning a NIP must be clearly justified.

How to get a NIP step by step – general procedure

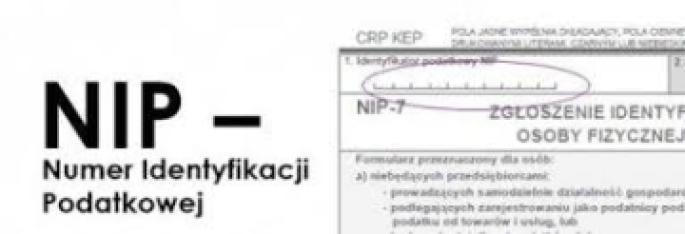

The question of how to get a NIP step by step refers to a standard administrative procedure conducted by the tax authority. Typically, a foreigner submits an application using the NIP-7 form. The procedure includes the following stages:

- determining the competent tax office;

- preparing documents confirming identity and the purpose of obtaining a NIP;

- submitting the NIP-7 application: in person, by mail, electronically (if applicable);

- waiting for the number to be assigned and entered into the register.

The answer to how to get a NIP number depends on the correctness of the application and the completeness of the documentation. Errors or an unclear administrative purpose may significantly extend the processing time.

Where to find a tax identification number after assignment?

After registration, many people ask where to find a tax identification number or where to find a tax identification number again if the document has been lost. Information about NIP can be checked:

- in tax returns;

- in employment or civil contracts;

- through electronic services of the tax administration;

- directly at the tax office.

A common question is also where to get a tax identification number again if the person no longer has access to documents. In such cases, an official request to the tax authority is permitted.

How to check a tax identification number?

The question how to check a tax identification number is relevant both for the NIP holder and counterparties. Verification is possible via official state services or by contacting the tax office.

The scope of accessible information depends on the legal basis for verification.

How a lawyer helps a foreigner obtain a NIP?

Legal support reduces the risk of formal errors and helps determine how to get a NIP number in a specific situation. A lawyer analyzes the foreigner’s status, determines whether NIP or PESEL is required, prepares the application, verifies documents, and supports communication with tax authorities. This is particularly important in complex or non-standard cases.

Obtaining a NIP number for a foreigner in Poland is a formal tax procedure that requires a properly defined legal basis, accurate application, and compliance with administrative requirements. Errors in documentation or misunderstanding the difference between NIP and PESEL may lead to delays or the need for resubmission. Each case requires an individual legal assessment, taking into account the status and purpose of the foreigner’s stay. Consultant Legal Marketplace brings together specialists who work with tax matters of foreigners in Poland, including the procedure for obtaining a NIP. Through the platform, it is possible to receive a legal assessment of the situation, document verification, and professional support in accordance with current legislation, without forming unreasonable expectations regarding timing or outcome.

FAQ

Question

How to get a NIP number for a foreigner in Poland?

Answer

The NIP number is assigned after submitting a NIP-7 application to the tax office if there is an administrative reason.

Question

Can a foreign tax identification number replace a Polish NIP?

Answer

No, a foreign tax number is not used in the Polish tax system.

Question

How long does it take to obtain a NIP?

Answer

The period depends on the correctness of the application and documents and can last from several days to several weeks.

Question

Where can I find a tax identification number after it has been assigned?

Answer

The NIP is indicated in tax returns, contracts and electronic services of the tax administration.

Question

Is it possible to check the tax identification number online?

Answer

Verification is possible through official state services or by contacting the tax authority.