Respect for expertise and client needs, the ability to explain in simple terms – this is why clients trust me.

Opening a Women’s Clothing Store in Gdańsk: A Case of Full Business Launch from Scratch

Starting a business in Poland involves a complex legal and administrative process. It requires choosing the right legal structure, registering the appropriate activity codes (PKD), and understanding taxation, accounting, and social contributions. In this case, attorney Olena Нlukha guided a Ukrainian entrepreneur through every stage of launching a women's clothing store in Gdańsk — from registering the company to launching online sales.

Case Context

A Ukrainian woman with experience in the fashion industry decided to start her own business in Poland — a brick-and-mortar women's clothing boutique with a long-term plan to expand into e-commerce. Her goal was not only to open a physical store but also to build a fully functional online shop with delivery services across Poland. Olena Нlukha served as the key legal advisor during the entire launch process.

Legal Support Stages

1. Choosing the Legal Structure

- A consultation was held to discuss the advantages of a limited liability company (Sp. z o.o.) for the retail clothing business

- Tax obligations, cost accounting, and shareholder liability were explained in detail

- It was decided to register the company using the online S24 platform

2. Company Registration and Business Classification

- Appropriate PKD codes were selected: 47.71.Z (retail sale of clothing in specialized stores) and 47.91.Z (distance selling)

- Formation documents were prepared and submitted, including the articles of association and ownership structure

- The company received its KRS (company registry), NIP (tax number), and REGON (statistical number)

3. Registration with Accounting and Social Systems

- The company was registered with ZUS (social insurance institution) as a contribution payer

- The corporate tax model CIT 9% was selected as the most suitable option

- Guidance was provided on choosing an online accounting platform and managing initial bookkeeping

4. Preparation for Offline and Online Sales

- A lease agreement for the physical store was reviewed to ensure legal and commercial soundness

- Templates were created for the online store’s privacy policy and terms of use

- A consultation was held regarding fiscal devices — when a cash register is required and how to register one

Result

- The business was fully registered and operational within 3 weeks

- The client received all required numbers — KRS, NIP, REGON, ZUS — without delays

- The online store was launched and began accepting orders within the first month

Frequently Asked Questions

Question

Is it necessary to open a Sp. z o.o. to sell clothing in Poland?

Answer

No, it is not mandatory. However, a limited liability company provides limited personal liability and is a practical form for scaling operations, especially in e-commerce.

Question

How long does it take to register a company in Poland?

Answer

Registration through the S24 system usually takes 3 to 10 days. However, the complete process including ZUS registration and obtaining all numbers can take up to 3 weeks.

Question

Is it necessary to purchase a cash register right away?

Answer

It depends on sales volume and sales channels. If the primary channel is online sales with payment to a bank account, a cash register may not be required at the start. However, this should be assessed individually.

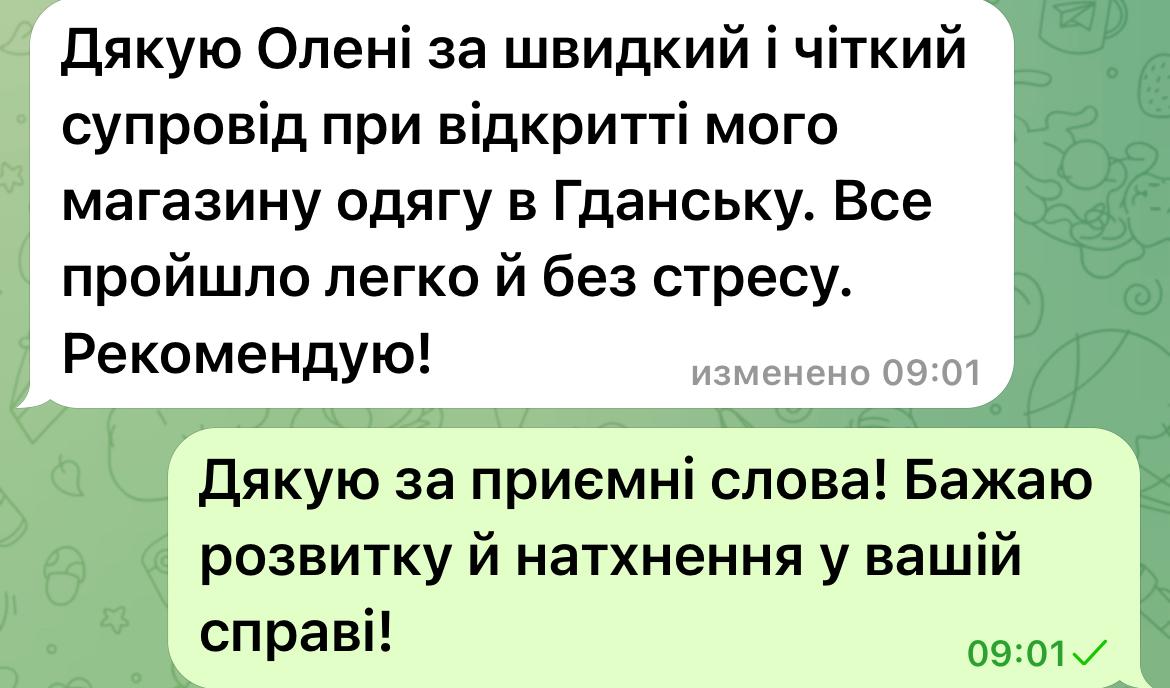

This case illustrates how valuable it is to have a professional legal advisor when starting a business abroad. Thanks to the guidance of Olena Нlukha, the client not only registered her company successfully but also gained clarity on all legal, tax, and procedural aspects. This allowed for a safe and effective start to a women’s clothing business in Poland, both in physical and digital retail.