My name is Vadym Korneliuk, and I am a lawyer with over 15 years of experience in the field of law. I specialize in labor law, tax law, and migration legislation. I hold a degree from the Kharkiv National University of Internal Affairs. I have held leading positions in the legal departments of large enterprises, worked as an assistant judge in the Commercial Court, and was the founder of the legal firm "DK LEGAL COMPANY" in Ukraine. I have been working as a lawyer in Poland for three years, providing legal assistance to both businesses and individuals. My expertise, combined with years of experience, allows me to offer high-quality and effective legal services. Personal slogan: DK LEGAL — experience and reliability in every case.

Tax Consultations on Taxation in the European Union

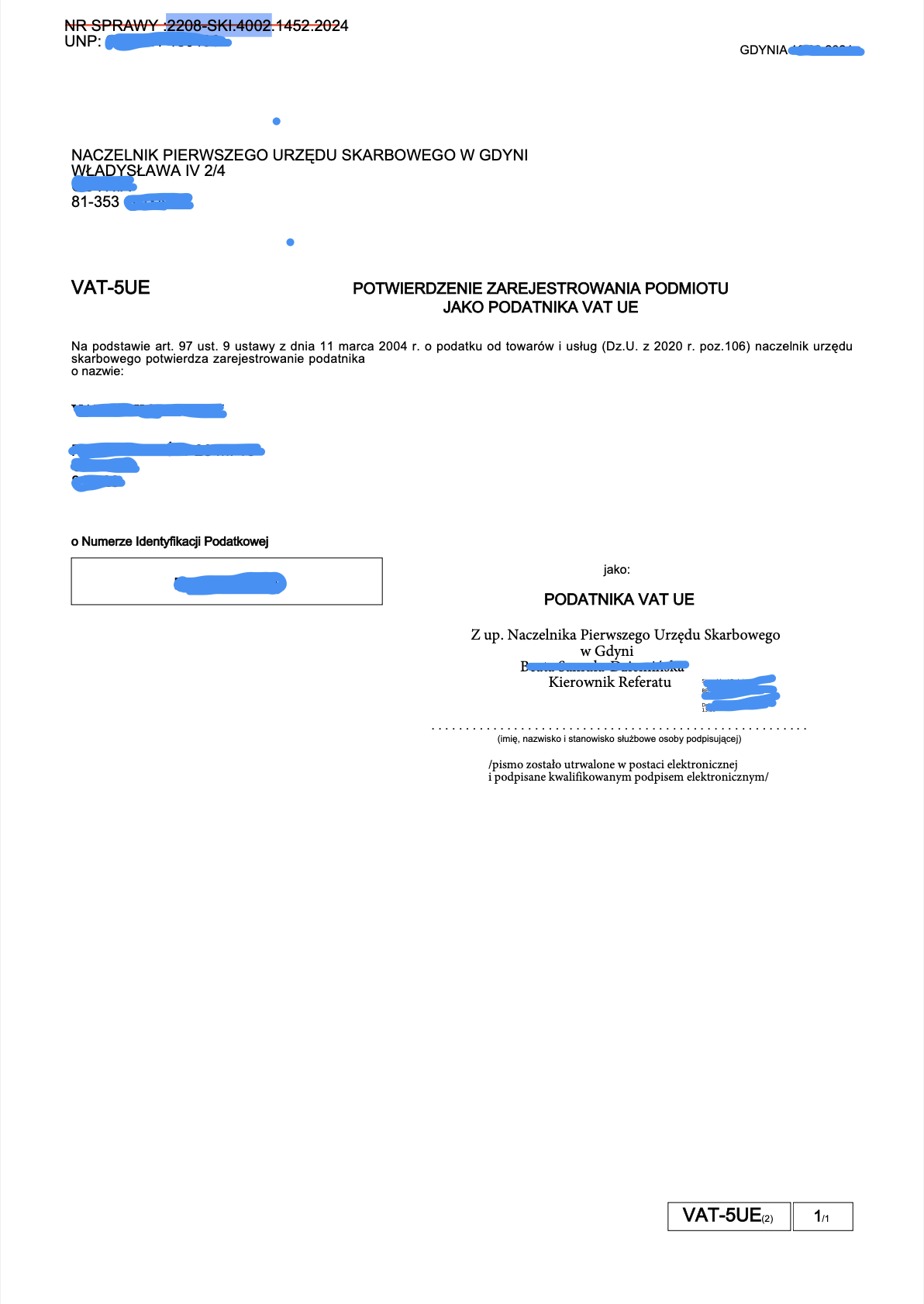

The client approached us with questions regarding the tax aspects of doing business in the European Union. Specifically, they were interested in the process of registering a company as a taxpayer in Poland and the tax obligations of entrepreneurs in other EU countries. Based on our analysis of the legislation, we provided clarifications on important aspects of taxation within the EU and the company registration procedure in Poland.

Key Stages of Registering a Business as a Taxpayer in the EU

- Choosing the Legal Form of the Business: First, you need to select the appropriate legal form for the business. In Poland, this can be a sole proprietorship or a company, such as a limited liability company (sp. z o.o.).

- Registering with the Entrepreneurs’ Register: After selecting the business form, you need to register the business in the Central Register and Information on Economic Activity (CEIDG). This allows you to officially operate a business in Poland.

- Choosing the Tax System: After registering the business, you must select a tax system that best suits the business's specifics. The choice depends on the company’s turnover and other criteria.

Main Types of Taxes for Entrepreneurs in the EU

- Corporate Income Tax (CIT): This is the tax paid by businesses based on the profit they earn. EU countries may have different rates for this tax, but it is mandatory for all companies.

- Value Added Tax (VAT): VAT is one of the main taxes that businesses must pay on all goods and services supplied within the EU. The VAT rate may vary depending on the country.

- Payroll Tax: If a company hires employees, it is required to pay payroll tax, which depends on the rate and type of employment contracts.

FAQs on EU Tax Legislation

Question

How do tax rates change for entrepreneurs when transitioning between EU countries?

Answer

Tax rates can change depending on the EU country. Each country sets its own rates for corporate income tax, VAT, and other taxes. However, there are general principles for many taxes that ensure compliance with EU-wide legislation.

Question

What are the tax benefits for entrepreneurs in Poland compared to other EU countries?

Answer

Poland offers a range of tax benefits for entrepreneurs, including low VAT and corporate income tax rates for small businesses, as well as the option to benefit from tax holidays in the early years of operation for new entrepreneurs.

Why Choose Us for Consultation?

- Professionalism: We have years of experience in tax consulting and assist entrepreneurs in choosing the most optimal tax solutions for their business.

- Individual Approach: Our consultations are tailored to each client, allowing us to find the best tax solutions for their specific business.

- Speed and Efficiency: We provide clear recommendations and help resolve any tax issues quickly without delaying business processes.

Results of Our Work

- Tax Optimization: We helped the client optimize their tax obligations, reducing costs and increasing profitability.

- Legal Support: We provided legal support for registering the business and determining the tax obligations according to Polish legislation.

Tax Consultations: We help identify the most profitable tax strategy for your business, considering all current legislative changes.

Business Registration: We provide full support in the business registration process in Poland and other EU countries.

Successful Results: Our clients achieve successful tax solutions and optimize their business processes with our support.

We provide a comprehensive approach to tax matters for businesses in the European Union and guarantee accurate and timely recommendations for efficient business operations.