My name is Anna Leus, and I am a lawyer with 20 years of experience in providing legal services to businesses. I specialize in tax, commercial, and corporate law, as well as in matters related to business organization and management, the preparation of CFC reports, and family disputes. I work with both businesses and individuals. Personal slogan: There are no unsolvable cases.

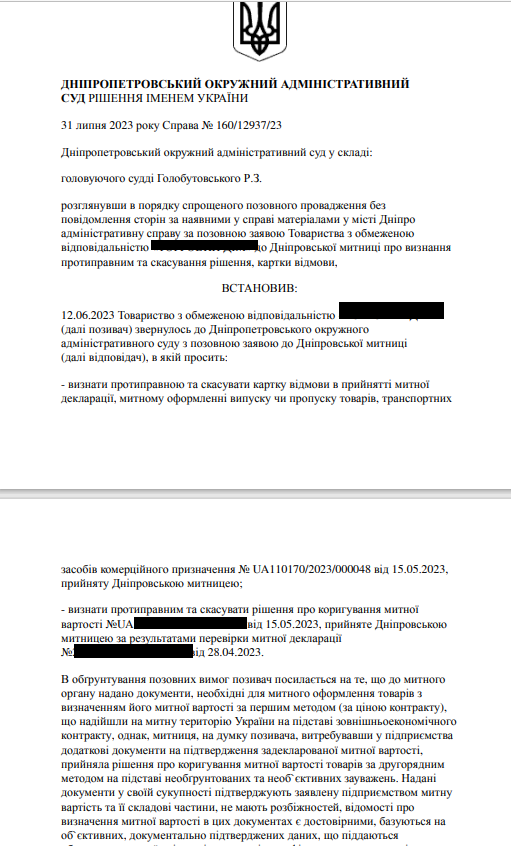

Case Overview: A business entity sought legal assistance after the customs authority refused to accept its customs declaration and unilaterally adjusted the customs value of goods imported under a foreign trade contract. The reason for the refusal and the adjustment, according to the customs authority, was discrepancies in the submitted documents.

The company considered such actions to be unfounded, as all the documents required to confirm the customs value using the first method (transaction value method) were properly prepared and submitted. The company viewed the customs authority's decision as unlawful interference in its business activities and therefore decided to file a lawsuit.

Legal Task:

- Preparation of an administrative claim:

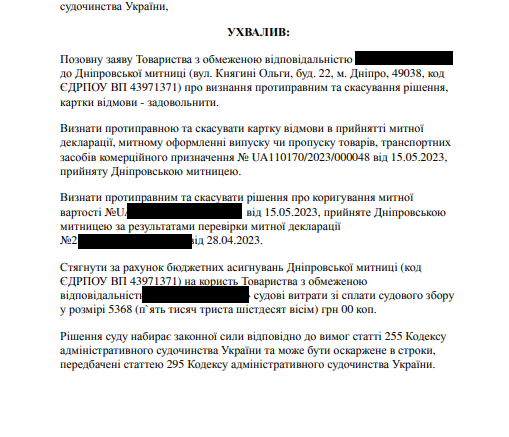

The lawyer filed a claim with the district administrative court, requesting: - To declare unlawful and cancel the refusal notice for the customs declaration;

- To declare unlawful and cancel the decision of the customs authority to adjust the customs value.

Claim Justification:

- All documents confirming the declared customs value (contract, invoices, payment orders, shipping documents) were submitted in full.

- The decision of the customs authority to apply a secondary method of customs valuation is unjustified and biased, as it fails to take into account all submitted evidence.

- The request for additional documents and the subsequent adjustment of value was unlawful and lacked proper legal reasoning.

- The authority did not specify any actual discrepancies or inconsistencies in the documents that could have served as grounds for the adjustment.

Decision and Recommendations:

Legal Strategy:

The primary goal was to prove the legitimacy of applying the first method of customs valuation — the transaction value — and to challenge the groundlessness of the customs authority’s intervention. All documents confirming the legality of determining the customs value under the first method were submitted in the course of the court proceedings.

Comprehensive Approach:

The case required a detailed analysis of all documents, legal justification, and the proper construction of an evidence base that would eliminate the possibility of manipulation by the customs authority. The statute of limitations for appealing decisions and adherence to procedural rules were also taken into account.

This case illustrates the effectiveness of legal support for business entities in disputes with customs authorities. Thanks to timely legal action, the company was able to exercise its right to judicial protection, challenge the unlawful actions of the regulatory body, and safeguard its economic interests. Practice shows that even in complex situations where regulatory authorities cite formal violations or questionable discrepancies in documentation, a well-prepared legal position can be decisive. A key to success in such cases is not only prompt response but also a deep understanding of customs legislation, supported by proper evidence collection and legal analysis of the regulatory authority’s actions. This approach not only protects the interests of a single business entity but also helps shape a positive practice for the business environment as a whole.