Marina Nikityuk is an accountant specializing in business support in Poland. Company formation (Sp. z o.o.), transport licenses, VAT, ZUS, CIT, Intrastat reporting. She works with transport, logistics, and agribusinesses. Assistance for Ukrainian entrepreneurs in the EU.

Comprehensive Accounting Support for a Transport Company in Poland: Practical Case Study

Successful operation of a transport company in Poland requires precise, systematic, and compliant accounting support. This case study presents cooperation with a major international logistics company operating across Europe with a fleet of over 15 trucks. The company needed to organize tax, accounting, and HR documentation, ensure effective communication with Polish institutions, and optimize operational costs.

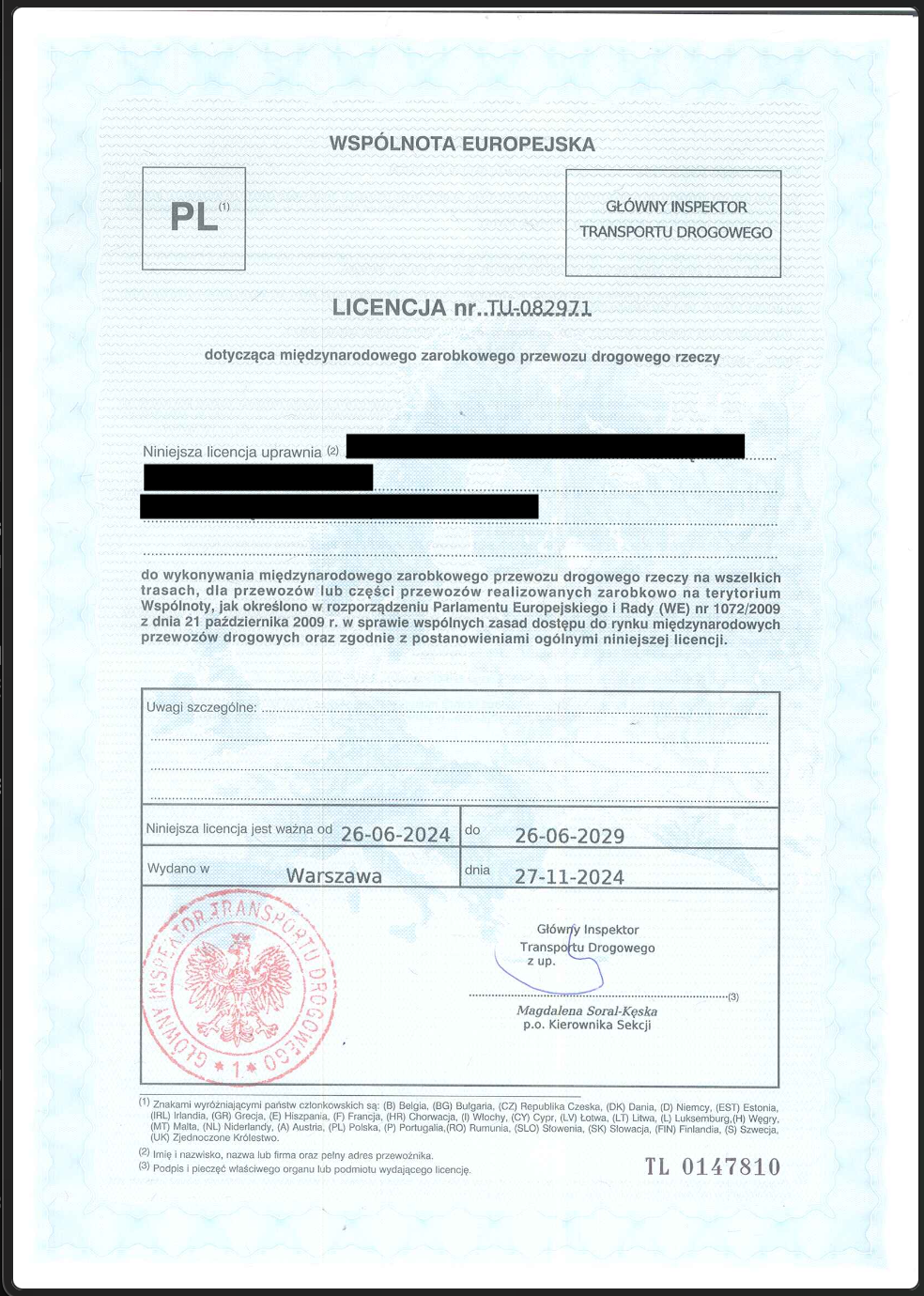

The solutions included full accounting services for the Sp. z o.o., submission of reports to GITD, settlements with ZUS, fuel expense tracking, payroll management for drivers, foreign trade operations support, and representation during audits and inspections.

Main Issues to Solve

- Frequent delays in submitting tax reports (VAT, CIT, ZUS)

- Lack of proper HR documentation for drivers

- Absence of fuel, repair, and toll expense control

- Challenges during GITD and tax audits

- Need for monthly profitability analysis per vehicle

Stages of Accounting Support

- Review of current accounting and HR documentation

- Recalculation of transport expenses: fuel, repairs, insurance

- Setting up the submission of VAT-7, CIT-8, ZUS DRA, and PIT declarations

- Preparation of employment contracts for drivers (Umowa o pracę / Zlecenie)

- Recording business trips, per diems, and working time

- Reporting transport operations to the GITD

- Preparing responses to inquiries from the Tax Office, ZUS, and Labor Inspectorate

- Performing periodic profitability analysis for each vehicle

What Was Achieved

- Full regularization of the company's accounting and tax reporting

- Implementation of HR documentation and payroll systems

- Development of an individual expense control system for each truck

- Timely submission of all required reports, avoiding penalties

- Successful passing of GITD and tax audits

- Over 24,000 PLN saved annually through expense optimization

Benefits of Cooperation

- Full transparency of the company's financial management

- Continuous communication with regulatory authorities

- No penalties or additional charges due to proper support

Comprehensive accounting and tax support for transport companies

Audit and inspection support (GITD, ZUS, Tax Office)

Expense monitoring for each fleet vehicle

Frequently Asked Questions

Which reports must a transport company submit in Poland?

Monthly VAT-7 and JPK reports, annual CIT-8 declarations, plus ZUS and PIT settlements, and GITD reports are required.

Answer

A properly set up reporting system helps avoid fines and manage tax obligations efficiently.

Can a transport company get VAT refunds for fuel expenses?

Yes, but all fuel expenses must be properly documented and linked to each vehicle's operations.

Answer

We implemented detailed fuel card tracking, enabling legal and regular VAT refunds on fuel and toll costs.

Accounting support for a transport company in Poland requires a deep understanding of local tax laws, accurate documentation, and continuous cost control. Thanks to professional assistance, the client avoided penalties, optimized costs, received VAT refunds, and achieved full financial transparency. This case proves that accounting in the transport sector is a key factor for sustainable business growth.