Work experience as an economist, analyst in structured large-scale chemical production (chemical processing of diesel, quarry and mining ore extraction, magnesium electrolysis, polyethylene and vinyl chloride production) across 10 plants. Issues of cost formation and pricing policies. Experience in agricultural management (production, logistics, and processing of cereals), cadastral matters, land lease. Entrepreneurial experience in the jewelry business, producing, concert activities, film distribution, intellectual property rights distribution, creation of computer programs (maps, games) using satellite navigation systems, intellectual property rights protection, and organizing an online store. Certified Auditor, series A, Auditor Chamber of Ukraine. 10 years of experience in conducting and organizing audits for businesses of various ownership forms and activity sectors (trade, manufacturing, construction, agriculture, institutions, etc.). Teaching experience: economics teaching in technical colleges, conducting over 50 seminars on company organization, accounting, taxation, privatization, and teaching at KNEU on CRM and ERP system implementation. Organizing distance learning. Experience in analytical work for the specialized weekly "Galician Contracts." Expert knowledge and experience in accounting (NSBO, IFRS) and taxation, foreign economic activity (FEA). Experience in managing a budget institution (general and special state budget funds). Experience in establishing new companies and conducting the reorganization of existing ones. Implementation of accounting and organizational systems. Optimization of structure and production or business flows.

Optimization of the Royalty Model for a Software Distributor in Poland

In an unstable market and a rapidly changing technological environment, companies engaged in software distribution need to adapt their business models in a timely manner. In this context, optimizing the royalty model is an important strategy for reducing costs and increasing profitability. One such case involved a Polish company that is a distributor of international software.

Situation

The company was paying royalties for each software license obtained from the developer, regardless of whether the license was sold to the end consumer. This resulted in significant costs for unrealized licenses, especially in an unstable market where demand for the product could be unpredictable. The task was to optimize these costs to reduce financial risks and increase the company's profitability.

Task

- Reviewing the contract terms: It was necessary to review the contract terms with the software developer to change the royalty payment model.

- Transition to a new model: Transition to a model where royalties are paid only for sold licenses, which would significantly reduce costs for unrealized licenses.

- Risk reduction: Improve the company's financial stability and profitability.

Solution

To solve this problem, several steps were taken, including negotiations with the software developer and a review of the contract terms.

- Negotiations with the developer: The main step was negotiating with the software developer to amend the contract terms. The updated terms stipulated that royalties would only be paid for actual sales of licenses.

- Justification of changes: An important aspect was justifying the need for a change in the royalty payment model, considering the specifics of the Polish market and the economic situation.

- Supplementary agreement: A supplementary agreement was concluded with the software developer that stipulated the new royalty payment model, where royalties are paid only for sold licenses.

- Tax optimization: Applying tools from Polish legislation for royalty tax optimization further reduced the company's costs.

Result

- Cost reduction: Thanks to the new royalty payment model, the company was able to significantly reduce costs for unsold licenses.

- Reduction of financial risks: Avoiding unnecessary costs for unrealized licenses reduced the company's financial risks.

- Increased profitability: Reduced costs and improved financial stability allowed the company to increase its profitability.

- Improved relationship with the partner: The changes in the contract terms also positively affected the relationship with the software developer, as both parties benefited from the new model.

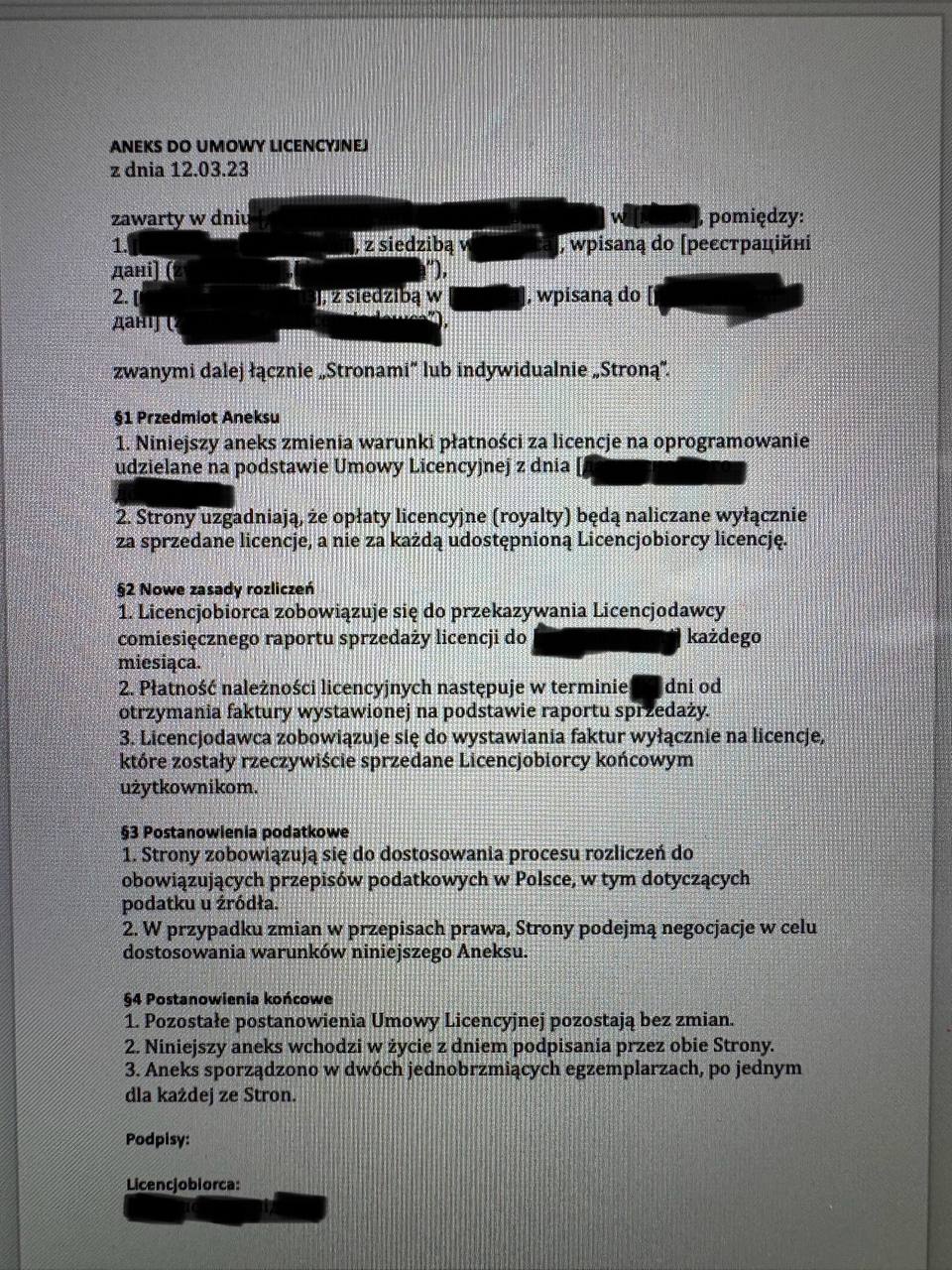

Sample Case Document

To amend the contract, a supplement to the licensing agreement was prepared. Here are some key provisions of this document:

- Indication of the contract parties (Polish company and software developer).

- Reference to the main contract.

- Description of the new royalty payment model (payment for sold licenses).

- Procedure for accounting and reporting of sold licenses.

- Terms of termination of the supplementary agreement.

- Provisions on the application of Polish legislation regarding royalty taxation.

- Signatures of the parties.

Features of Polish Legislation

Poland has developed legislation in the field of intellectual property and licensing agreements. Additionally, there are opportunities for optimizing royalty taxation, particularly through the application of preferential royalty tax rates. It is also important to consider the requirements of Polish tax legislation regarding documentary evidence of royalty expenses.

Questions and Answers

Question

How can royalty expenses be reduced in an unstable market?

Answer

Royalty expenses can be reduced by transitioning to a model where royalties are paid only for actual sales of licenses. This allows the company to reduce costs, avoid unnecessary expenses for unrealized licenses, and decrease financial risks.

Question

What documents need to be changed when reviewing contract terms with a software developer?

Answer

The main licensing agreement needs to be amended, and a supplementary agreement should be concluded that outlines the new royalty payment terms, including payment only for sold licenses.

Why Choose Us?

- Expertise in cost optimization: We have experience in reducing royalty costs for companies in various industries.

- Knowledge of local legislation: Our experts are well-versed in Polish tax legislation, allowing us to ensure effective royalty tax optimization.

- Negotiations with partners: We assist clients in conducting effective negotiations with partners to achieve favorable contract terms.

Results of Our Work

- Cost optimization: Thanks to our recommendations, the company significantly reduced royalty expenses.

- Increased profitability: We helped the company increase profitability by reducing costs and financial risks.

Legal Consulting

Tax Planning

Negotiations with Partners

Optimizing the royalty model is a key step in reducing costs and improving the financial stability of the company. Through effective negotiations and changes in the contract with the software developer, the company was able to significantly reduce its costs and increase profitability.